The **Bank of England** is the central bank of the United Kingdom, established in 1694 by an act of Parliament primarily to raise funds for the English government to wage war against France. It was initially incorporated as a joint-stock bank with limited liability and granted a royal charter, giving it unique privileges, including a monopoly on issuing banknotes within London until the 19th century[1][2]. Its headquarters are located in the City of London, on Threadneedle Street, a site it has occupied since the 1730s[1].

Historically, the Bank of England evolved from a government debt manager and banker into a central bank with broader responsibilities. By the 19th century, it undertook key central banking roles such as printing legal tender, acting as lender of last resort, and safeguarding the nation's gold reserves[1]. The 1844 Bank Charter Act was a landmark, granting the Bank a monopoly on note issuance in England and Wales and establishing that notes be backed by gold, laying the foundation for the gold standard and long-term price stability[3].

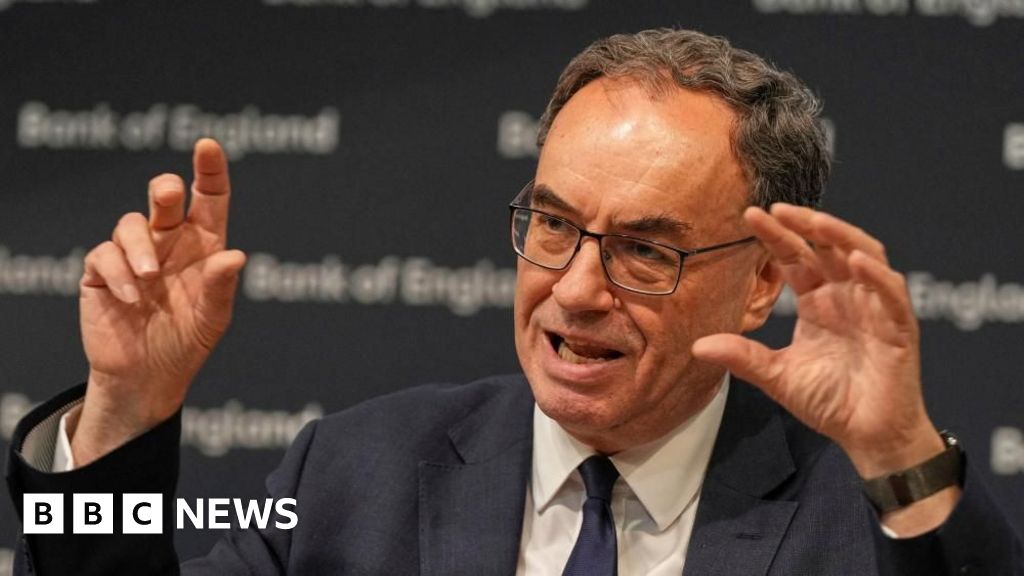

The Bank's role expanded over time to include maintaining monetary and financial stability in the UK. It became the government's banker and debt manager, managing government accounts and loans[3]. In 1997, it was granted operational independence over monetary policy, with its Monetary Policy Committee setting interest rates to maintain a 2% inflation target, thus enhancing its credibility and effectiveness[5].

Key achievements include its pioneering role in managing national debt, establishing the gold standard, and acting as a lender of last resort during financial crises. The Bank also leads financial stability efforts, providing a backstop for the banking system during panics[3][4].

Today, the Bank of England remains a foundational institution in UK finance, balancing traditional central banking functions with modern challenges in monetary policy, financial regulation, and technology innovation. It also issues UK banknotes, manages gold reserves, and continues to support economic stability in a comple